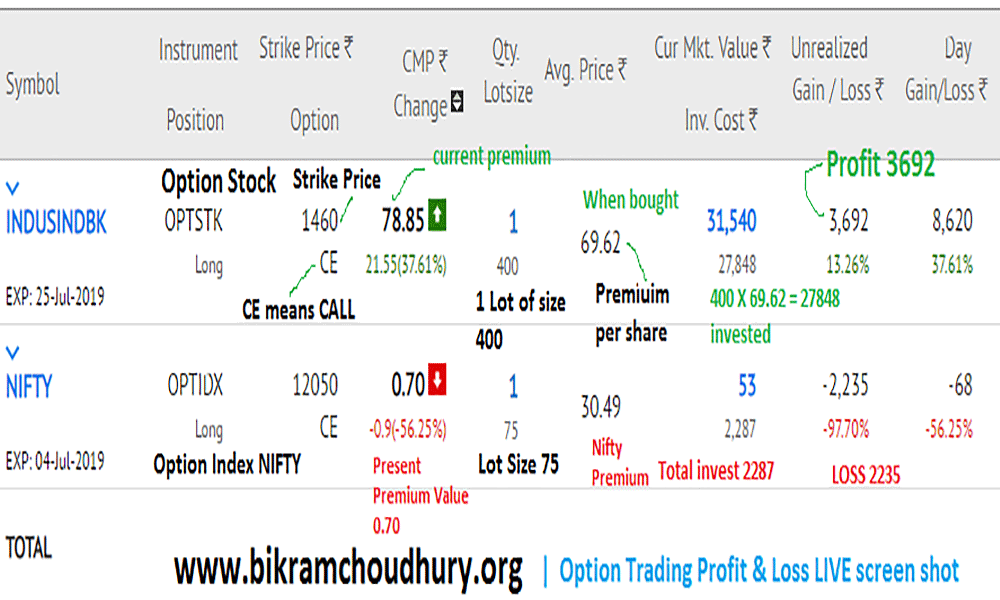

A beginners tutorial on option trading. What is a CALL OPTION ? What is called LOT size, STRIKE PRICE and PREMIUM in options trading ? How to buy an option and how to sell it after buying?

Whats is Option Trading? How to buy a Call Option

Options trading is not for beginners, because it is risky & called a trade of unlimited profit with limited risk. But to do options trading in live market, you should learn option trading courses.

Trading instrument

Stock, Index, NIFTY 50, BANK NIFTY, currency all called trading instrument. Trading instruments are those on which you can bet, that it’s price will go up in near future, or go down. When the price goes up normally you buy an instrument and when the price goes down you sell an instrument. The most traders do these trades in stock market.

If you have money buy & sell stocks

- I am going to tell you with example of one stock named Indusind Bank, instead of doing options trading you can easily buy some quantity of Indusind Bank stocks, say 100 shares, when the price will go up and you can sell it at higher price and book profit. Share trading on stocks explained here

- The price of one share of Indusind Bank costs Rs 1400 ,

- Say you are going to buy 100 Indusind Bank shares,

- Then you need to spend 140000 Rs.= 100 x 1400

- If you have this amount in your bank it is okay, just buy it and keep the shares in your possession and

- When the price will go up, sell the stock and book profit.

So what you need is a good amount of money to buy some shares of Indusind bank to get a good profit, if you have such money..then you can easily buy shares and sell later to book profit.

Other free tutorials on option trading

This is a tutorial on stock options , but if you are seeking more read..

When you need to buy Options ?

When you know that a share price will go up, then you should buy a CALL options on the respective stock, when you know that the share prices go down there you should buy a PUT options on the stock.

- Say the stock price of Indusind Bank is now 1400 rupees,

- Cost for each share = 1400 Rs (INR) = $ 22 USD

- You know very well that the stock price will go up very soon

- i.e within next 7 days it will reach 1500 Rs (INR) = = $ 23.5 USD .

- So this could be a very good opportunity to buy a call options on Indusind Bank stock.

When you donot have much money to buy stocks, then you can opt for Options Buy. E.g to buy Indusind Banks stocks you need 1,40,000Rs., and you dont have that much money, just buy a CALL OPTIONS on Indusind bank stock.

What you need to buy a call options

You need to buy a Lot or few lots

When you want to buy a CALL OPTIONS, then if you need to buy a group of shares called lot, that indicates a fixed number of shares. For Indusind Bank 1 Lot = 300 quantity of shares.

According to companies like SoFi, when you are purchasing shares you can freely choose the quantity of shares you need to buy, say 100 or 500 or 10 quantity of shares of some stock like indusind bank, you can choose the quantity arbitrarily as you like.

But when you are going to buy a CALL options or PUT options, then you need to buy at least 1 Lot which refers to a fixed quantity of Shares like 300, 400 or few thousands of shares fixed by National Stock Exchange of India NSE India.

Options premium:

- When you are planning to buy a call options then you don’t need to spend the huge money @ 1400 per share price, instead you need to pay a small amount Rs 30 for each share of a fixed lot size.

- If the lot size is 300 then you need to pay total premium value = Lot size 300 x 30 = 9000 Rs

What is Rs 30 premium @ 1500 Strike price

- You assume that the share price will go up to Rs 1500 /1600 in next 7 days.

- Now the stock prices is Rs. 1400.

- Options premium value is calculated on few higher prices and few lower prices called Strike Price calculated with respect to present stock price Rs 1400. So example of higher strike prices will be 1440 , 1460 1480,1500, 1520, 1540… higher than present price.

- Example of lower strike prices will be 1380, 1360, 1340, 1320….. lower than present price Rs.1400.

- For each strike price, there exists a premium value on that strike price, which is calculated with respect to present stock price Rs.1400.

- Present stock price Rs 1400. (1500 Strike price premium = 30 Rs / 1520 Strike Price = 29 Rs / 1540 Strike Price = 25 Rs)

- Even below 1400 Strike price exists (E.g 1380 Strike Price premium = 20 Rs / 1360 Strike Price premium = 15 Rs …)

- So when stock price is going 1400, you buy 1 lot CALL OPTIONS at 1500 Rs strike price @ Rs 30 premium per share to be multiplied by lot size.

When you buy a CALL OPTIONS it means – if the price reaches Rs.1500 then you will get a right ( not an obligation, you can do it if you wish) to buy 1 lot shares = 300 shares of Indusind bank @ 1500 each which is the strike price. If the price goes up more, then also you will be still able to buy 1 lot share in the same Rs.1500 price per share, even when the share price is going 1600/ 1700.

That is a contract between you the CALL OPTIONS BUYER and the CALL OPTIONS SELLER. CALL OPTIONS Seller get the premium amount you pay. You can buy any number of lot s like 1,2,3 .. lots, but no fraction of lots allowed.

Now Practical Scenario Date Wise:

- 1/July/2019 : You bought Call Options @ 30 Rs premium of 1500 Strike Price. Total Premium = 30 X 300 (Lot size) = 9000 Rs.

- 1/July/2019 : Indusind Bank Stock Price 1400 Rs

- 3/July/2019 : Stock Price gone higher to Rs 1440, Premium value increased to Rs 40. Your profit (40-30) X 300 Lot size = 3000 Rs

- 7/July/2019 : Stock Price gone more higher to Rs 1490, Premium value increased to Rs 60. Your profit (60-30) X 300 Lot size = 9000 Rs.

- 8/July/2019 : Stock Price gone to Rs 1540, Premium value increased to Rs 100. Your profit (100-30) X 300 Lot size = 21000 Rs

So on 8th July 2019 you square off your purchased call options (i.e sell the purchased call options) and book profit.

- When you sell on 8th July 2019 : you get Rs 100 X 300 = 30000 Rs

- You paid as premium Rs 30 X 300 = 9000 Rs

- Net profit Rs 30000 – 9000 = 21000 Rs

So in an options trading trade you paid Rs 9000 and got profit Rs 21000. Can you imagine the return % of your investment. It’s options trading.

For Share Market Training Courses Visit This Page

What can be the maximum loss in an options trading?

- The premium amount you paid is the maximum amount you can loose.

What can be the maximum gain in Options Trading?

- Unlimited profit is told, but 30% to 400% return is seen normally sometimes more. It depends how you trade in options.

What is time decay in Options Trading?

- With time premium value decreases if the underlying stock value or Nifty Index stays in same level, with time premium degrades so you shall get less return than you invested ,

- The Nifty Options in picture shows Rs 30 premium came to Rs 0.70 less than 1 Rs. With time loss can be this.

2 replies on “Option Trading Tutorial for Beginners”

What are the course fees ?

Please call us over phone