A Nifty options trading tutorial on Indian Index Nifty 50 explained with example and images. In this tutorial I have shown – how to buy a call option on Nifty Index. We purchased a call option on Nifty 50 Index and Squared Off ( Sold ) it and got some good profit.

- In my previous tutorial I have shown that how to buy call options on a stock and how to sell (square off) it in higher price to book profit.

- In another tutorial I have shown the basics of stock market trading and how to buy sell stocks to book profit.

Those previous tutorials were fictitious examples, but the following tutorial is on real data and trading.

Nifty Call Options Trading Explained

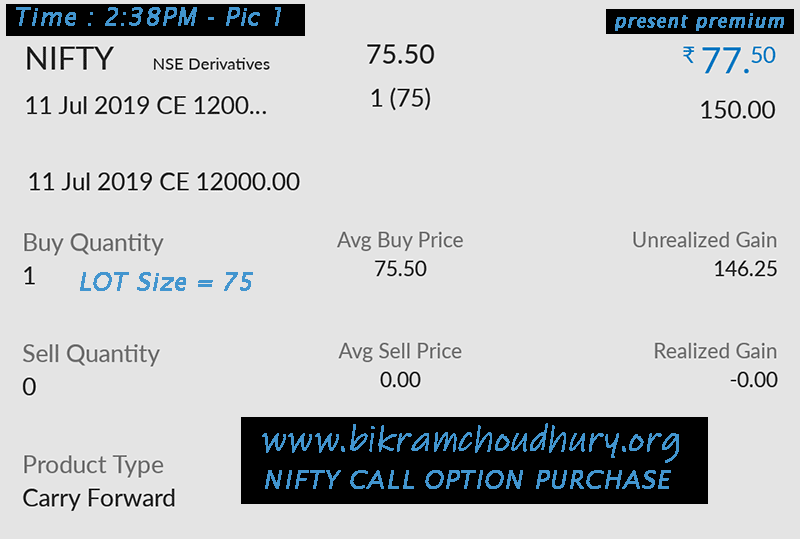

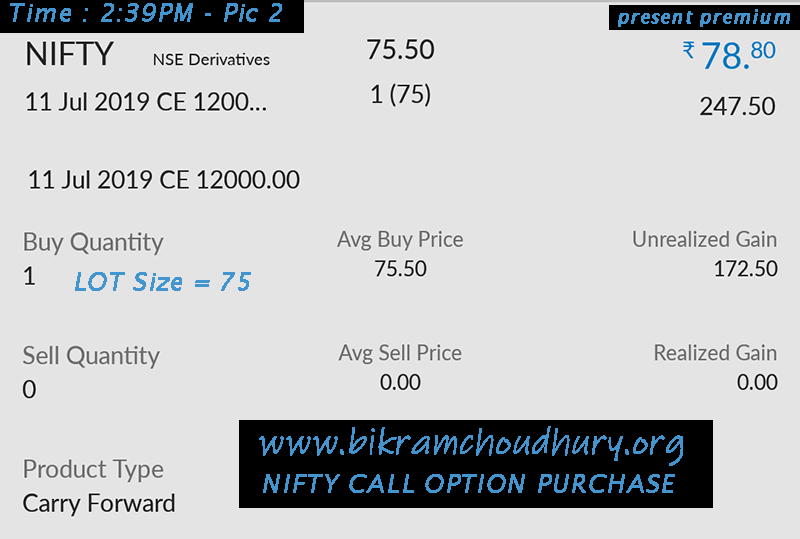

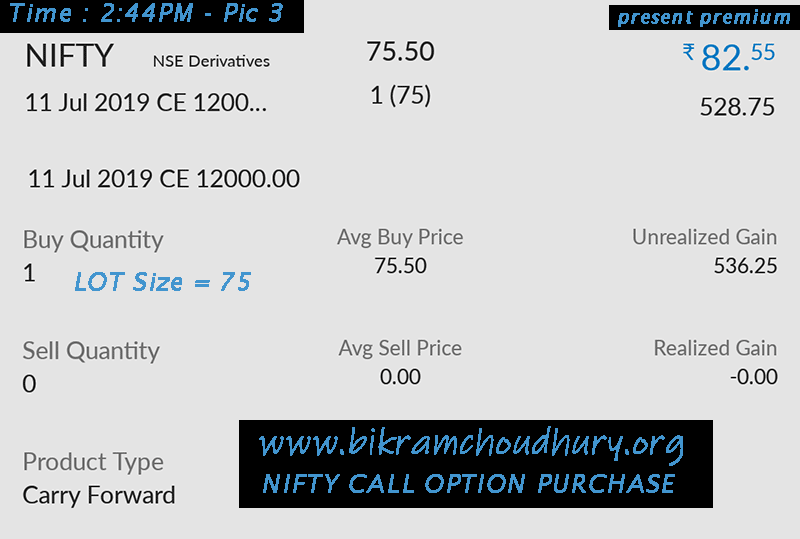

I am going to show you how you can buy Nifty index options and and sell it (square off) to book profit. The whole options trade was done today and after that I am writing this article, this is a real example on Nifty call option purchase, done today by one of my Options Trading Course student and I have shown here at different times the Nifty Options premium values, how it is increasing with time and how the total profit is increasing with time all has been done today.

The pictures are the screen shot of the broker firm’s trading screen- If you closely look the images below , you will see

- NIFTY CE 12000 : that means it is a NIFTY call option (CE) on the strike price 12000, when NIFTY was at the level 11940 and the then premium value was 75.50.

- Time was : 10AM morning.

- Total premium I paid = Lot size 75 X 75.50 = 5663 Rs.(INR)

- I paid total premium to the Nifty Call Options Seller, who sold me the Call Option @ strike price 12000,

- I bought the call option from the options seller.

- NIFTY Options Lot Size is 75. You have to buy at least 1 lot and premium

- Remember : that time NIFTY 50 Index was going 11940. We were expecting NIFTY Index will go higher and reach or cross 12000 level.

- Call Options Premium is always paid by the Call Options Buyer (we the buyer) to the call options seller (we don’t know).

The Nifty Option was bought at the morning 10:00 a.m. and it was squared off in the afternoon around 3 p.m. today 4th July 2019.

Buy and sell done in the same day and you can consider it as intraday options trade on NIFTY 50 INDEX.

The reason why we bought the Nifty 50 Call Options Contract

- I told to buy it today because tomorrow is our national budget.

- So there is high possibility that the market will go up tomorrow or the next day for this reason.

- As I know that there is a high possibility that market will go up within next 2/3 days, so we bought this call option contract on Nifty index assuming NIFTY will go much above 12000 Nifty level.

If you look at the above picture check the present premium value 82.55 Rs, we purchased @ 75.50 Rs, and Unrealized gain showing 528 Rs, investment was Rs 5663.

Important Note : When you buy a call option or put option there should be a solid reason….

- There should be some volatility in the market,

- That the market will go up or market will go down and there should be some movement in the market or the respective stock.

- This is the fundamental reason to buy an option on a stock or Nifty 50 Index or Bank Nifty.

More Profit : Present premium value 86.50 Rs, we purchased @ 75.50 Rs, and Unrealized gain showing 825 Rs, investment was Rs 5663. Calculate return ( 825/5663 ) x 100 = 14.5 % in a day.

So for this reason ( see the black box above, Important Note section)- I bought the call option today on Nifty 50 index in the morning @ 75.50 premium value, but after purchasing the Nifty Call Option, the market didn’t go high that much today and remained on the same level for the whole day.

In the afternoon there was some movement and the Nifty index gone higher to 11970 level and respectively the options price of the premium increased, so increased the net profit & the gain.

We booked Profit and closed the trade: Present premium value 87.70 Rs, we purchased @ 75.50 Rs, and Unrealized gain showing 915 Rs, investment was Rs 5663. Calculate return ( 915/5663 ) x 100 = 16 % in a day.

The concept of always same… whether you are buying call options on stock/Nifty 50 Index/ Sensex/ Bank Nifty there should be some movement… should be some volatility on the respective underlying … Underlying means the stock or the index on which we are buying options.

Buying an Option means either buy a call option or put option.

- When the stock price or the Nifty Index is going up then you should buy a call option and

- When you know that market will go down so the Nifty will be down or any particular stock price will go down, then you should buy put options.

- The movement should be in maximum 7 days.

Why we are buying options, not selling Call or Put Options

I am discouraging the newcomers to the Indian stock market, to sell options, i.e selling call options or selling put options…

- Not only for the reason that it involves comparatively large amount of money and the loss potential is big…

- But also it should be done in a professional way and not suitable for the newcomers to get into options selling,

- Because it is too risky for the newcomers …who has less understanding on the overall market.

When the Nifty is going higher from 11950 level towards 12000, the Nifty Call Options premium value was increasing from 75.50 Rs to 87 Rs and this premium value is time dependent.

Time Decay in Options Trading

- Because all happened today so less time passed, so I got profit.

- But if the same thing happens after two days or three days, and the Nifty index stays at the same level like 11980 i.e little higher

- Then the premium value will get decreased and I shall get less value than I invested.

- The premium will degrade to Rs 50 from Rs 75.50,

- This is called time decay.

After buying a call option, when the time is passing by and stock price or index is not going much higher and staying in the same level, compared to the level when we bought the call option, then we will see that the premium value is decreasing rapidly everyday, this decrease is called Time Decay in Options Trading, which is the the main disadvantage of buying call options or put options if market does not move rapidly.

In Call or Put Options buying, time decay is our main enemy.

Anyway I bought and sold the Nifty 12000 Call Options and after getting a profit around 900 Rs by investing Options premium value Rs.5000. Got almost 20% return in a day which is a very common in Nifty index call options trade. Go through the images and check it. Click the following link to learn option trading courses in Kolkata India, or learn option trading courses online from option trading teachers.

Other free tutorials on options trading

This is a tutorial on NIFTY options , but if you are seeking more read..