Share trading explained for beginners. Know what is stock market & share market trading. How to trade in share market? Different types of trading in share market explained in the context of Indian stock market.

Unfortunately without knowing anything about stock market & share trading common people comes to stock market with greed and the following expectations.

Daily Earning Expectations by trading

- How to earn 1000 Rs (INR) per day in stock market?

- Want to earn 10000 Rs to 20000 Rs (INR) per day from share market

- As monthly income – How to earn 1 lakh rupees per month (1500 USD) from stock market.

Join our Share Trading Courses

People comes to stock market mainly driven by greed and for quick money, most don’t have the patience to learn anything about it. Earning regularly from share market is not so easy.

Steps of earning by share trading

- First Learn

- Then practice share trading.

- Then start actual trading to earn.

If you are a beginner in stock market then focus on the following lines

- How to start share trading with 1000 to 5000 Rs in stock market

- How to invest 1000 – 10000 Rupees in share market

If you jump into share market with greed then you should be driven by greed for more & more money which increase the chance of huge loss. Even your whole capital.

First know the stock market

If you are new to

Share trading is one of the

You

What is Share market or stock market

It

When you buy shares of a company

By purchasing a stock you shall be

- You may buy any amount as per your budget starting from 1 share.

- To buy and hold shares in your account you need money in your DEMAT account.

- You shall get profit when you sell the shares in higher price than the price you purchased in past.

If the profit goes down or the company makes losses or involved in unfair activities then its share price may go down and you may lose money. Not the whole , but a portion of your invested money.

Different types trading done in stock market

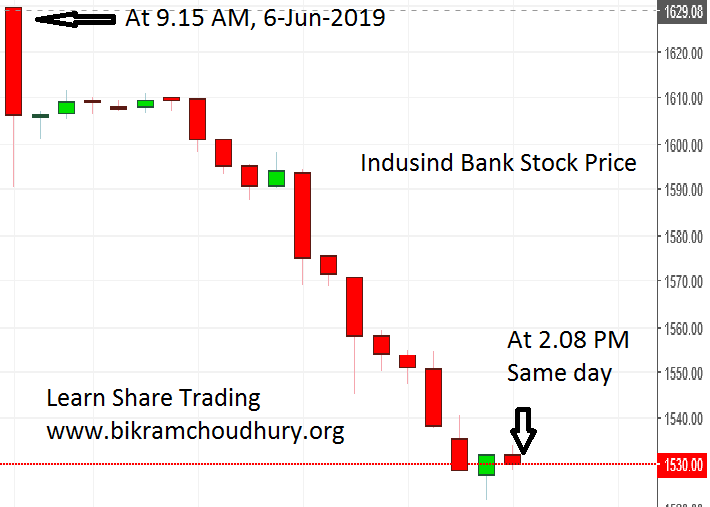

Intraday Trading: You buy a stock of some quantity , say 100 Indusind Bank stocks and sell in the same day. First Buy and Then Sell. There is no permanent investment, no permanent blockage of money. If price gone lower after purchasing the stock, you make losses. If you sell in higher price you make profit in same day. Learn Intraday Trading Courses

How much money can you earn in Intraday Trading?

- You can earn 100 Rs to 10000 Rs even 20000 Rs in a day as per your risk taking capability.

- You can make a same amount of loss or more also in Intraday Trading.

- If you face loss then you can convert the trade to delivery mode if you have money in bank.

Delivery Trading: You buy a stock of some quantity , say 100 Indusind Bank stocks and sell in the next day or sell after 7 days, 30 days, 365 days or after 20 years. You need to invest and need money.

- Long time delivery mode should be treated as investment.

- 2 times to 40 times return possible in 2 years.

- On average good return is seen.

- For bad investment 90% loss may be faced.

Swing Trading: You buy today at some price, after few days of few weeks or few months (upto 6-8 months) when price gone higher you sell it.

- If price gone lower after purchase, you make losses.

- If you sell in higher price you shall make good profit. 10% to 100% profit possible.

- Profit depends on stocks.

- If you face a loss then you can hold it.

- 30% to 70% loss you can face

Option & Future Trading: Explained in this article- option trading explained on stocks & option trading explained on NIFTY 50 index. Should not be done by the beginners. Start after 1 year spending in stock market.

To learn options trading in India and online courses on trading options visit learn options trading for beginners in India

Why people sell stocks when it’s price starts falling?

- For profit booking of already purchased shares.

- For loss booking, to prevent further loss. When you have purchased at high price and after purchase of stocks, price starts to fall.

Yes therepossibility that the share price maygo down more and more making the loss higher. - So for the fear of more loss traders sell stocks to save capital.

What is short selling in stock market

Stock price

- When market started it was 750 Rs, at 9.15 AM.

- At 9.30 AM it is 945 Rs,

- at 10 AM it is 938 Rs.

- at 2PM price is 920 Rs.

- So at the very beginning of the day you sell Infosys 100 shares (at 9.30 AM) and buy it at the end of the day (say 2PM, that time price was 920 Rs).

- You need to buy same quantity of share.

- So you sold Infosys first when you didnot buy it at all, and to make balance you buy it at the end of the day.

- Ultimately it appears as you bought at Rs 920 and sold it at Rs 945

- Your profit 945-920 Rs X 100 = 2500 Rs in a day by short selling.

Selling in future market

Sell first then buy in same day is short selling, shown above. But by future selling it can be done for many days, sell today an buy after 20 days.

- At this moment the Tata Motors Company share price or stock price is 175 Rupees( Rs / INR) approximately.

- Which was Rs 230 to 238 a month

ago. - But Tata Motors profit has gone down 50% recently.

- So share price came down from 238 Rs to 175 Rs in the past one month or so.

- Those who bought Tata Motors stocks @ Rs 230 (say 100 or 1000 quantity shares) & if they sell all the quantity now they will lose (230 – 175 = 55) Rs per stock(share) approximately.

- So if they have bought 100 shares of Tata Motors, they will lose 5500 Rs

and , if they bought 1000 stocks they will lose 55,000 in just one month.

When Stock Price falling you can earn money too…

This is the story of loss, but if somebody knows in advance that the share price will go down, then he can sell Tata Motors 100 quantity or 1000 quantity, in advance without buying it in the month of April 2019 and will buy it in May 2019. This can be done by Options Trading or future selling in stock market

So a smart guy can earn Rs 55,000 /40,000 / 30,000 it does not matter what is the

Is it possible ? Can I sell without buying a stock ?

In the above

Sell first, then buy

- Surprised?

- How they will sell if they have not bought it .. yes it is true in stock market

- You can sell a stock in advance if you have not bought it.

- So this is the story of trading without investment, and you have to close

whole trade today in short selling.

I have just told you the story of selling in advance of Tata Motors stock in

Buy now , sell later and book profit

- Today 4th June 2019, Tata Motors company stock price is around 174 /173 Rs per share.

- It is much less price compare to Tata Motors stock recent history.

- In

last one year, itgone to the peak price of Rs 400 to 450. - So it is a very lower price for Tata Motors stock and I have seen that it

gone down to Rs 150 (Yearly lowest) and it came back or bounced back from the price and gone to 200 to 238 Rs. - So by this logic,

present price Rs 175 is notbad . - If you buy it now 10/100/1000 quantity of Tata Motors stock as per your budget or money , when the share price will go up in future and will reach 200 or 250, then you will get rupees 25 to 75 per stock .

- So your earning is

- 250- 750 Rs for 10 quantity Tata Motors Stock purchas

e R s 2500 – 7500 for 100 quantity- 25000 – 75000 for 1000 quantity.

- This is all you can get in short time like 1 month to 3 months.

Does it sound complex ? Does it requires much labour. Just invest in proper time and get the Apple when it will get ripe. Yes you need some money to play in Stock market.

How much money you can earn in stock market

- It does not make sense at all because it depends on the invested amount or the amount on which you can take

risk . Mos t of the trading systems will give you 10 to 15 times margin per day, forexample say if you put 10000 rupees for share trading in your account, and you can treatupto 1.5 Lakh rupees margin in a day, andupto 30000 Rs margin for 1 month to 3 months.- That means you can buy 1.5 lacs Rupees stock and bound to sell in

same day by investing only 10000 Rupees. - If you buy and hold a stock for 3 months to 3

year , 30% to 5 times return is possible. - Indiabulls Ventures stock price was Rs 25 per share in 2017, in 2018 it gone to 800 Rs, 40 times return.

Share trading types : Intraday & Delivery mode

Intraday Trading explained–

Say another stock, Larsen and Toubro price per share is 1500 Rs.

The story of gain in Intraday trading

- Today at 9.15 am

stock price is 1500, you buy 100 quantity. Total cost price of 1.5 lac- At 11 am stock price gone up to Rs 1514.

- Rs 14 up per share

. Yo u sell all 100 quantity of stocks. S o you earn Rs 1400 in a day.

Now how can you lose money in Intraday Trading

But if stock price goes down to 1480 , you will loose Rs 20 per share, all

total Rs 2000 for 100 shares. But if you don’t want to sell ? Then you need to put Rs 1.5 lacs , cost of 100 Larsen and Toubro stocks in your DMAT account and you can hold it life long.

Then it’s no longer intraday trading and it will be called you purchased stock in delivery.

Delivery Trading Explained

When you buy some stocks and keep it in your DMAT account for at least one day to life long, then it is said that you bought the stock in delivery.

Where as in intraday trading you need to buy and sell stock in the same day during the trading session from 9:15 a.m. to 3:30 p.m.- But if you faced loss and stock price came down lower after purchasing the stocks in Intraday mode, then

what ? - You can convert it from Intraday to

Delivery mode and hold it for lifelong . - Delivery trading is holding a stock for at least one day.

- E.g Buy today and sell tomorrow, or day after tomorrow or the next day to after 1 month/ after 10 years/ after 20 years then this will be in delivery trading and you need to put money for the purchased stock in your account.

About DMAT account

- You can open a DMAT account in any bank or in any share broking firms to trade in

stock market or share market. - You can not use your normal savings or current bank account for share trading.

- You are bound to open a DMAT account either in the same bank or in some other banks or in some share trading firms or

stock broking firms to earn money in stock market.

Where shall I open a DMAT account?

- Shall I open a DMAT account for stock trading in a

bank ? - OR in a

share / stock broking firm. - Are the Stock Broking firms a safe place for Share Trading?

- Why should I open

DMAT account instock broking firms instead of opening a DMAT account in abank ?

I am giving all the answers one by one-

For Intraday traders or Delivery traders Stock

Margin is a very big thing for the traders because normally you don’t

I have explained below what is Margin in share trading below in details in the next section and the margin is not free, it is only free for

Margin in Stock market

Traders always love to trade on

- Say you have 10000 Rs, so you can buy 20 quantity of a stock of price 500 each.

- If the stock price goes

up say Rs 10 you get Rs 20 X 10 = 200 Rs with the help of your 10000 Rs investment in a day (Intraday Trading). - But broking firms will give you 15 times (15X) money, so you get 10000 X 15 = 1 Lac 50000 Rs to trade.

- So now in Margin you can buy 300 stocks in a day instead of 20 stocks in your own money, at the end of the day you got 300 X 10 = 3000 Rs, now is it clear what is margin?

Margin is the extra amount of money provided by the

Normal banks don’t provide any margin that is extra money for trading but the share broking firms provide

Margin for delivery trading explained with 18% interest rate

In delivery trading some

- If you invest 10000

Rupees , then you can buy stocks ofupto 30000 rupees. Th extra 20000 rupees you will getas loan from the share broking firms @ 18% annual interest rate.- You shall get this loan for

maximum of 30 days to 90 days period. - Normal traders open DMAT account in share broking firms, instead of banks like State Bank of India, HDFC, Axis, ICICI.

CAUTION : If you do not put the extra 20000 rupees in 90 days or 30 days in your DMAT account then the share broking firm will sell the extra amount of stocks you purchased in 20000 Rs loan amount.

If you don’t want to use margin then it

s okay, you can use your bank’s DMAT account and you don’t need to open a DMAT account in share broking firms. ‘

So when to buy a stock and sell it in stock market

Stock price fluctuates everyday and depending on the stock or company it varies 10 paise to 1000 INR ( rupees ) everyday and there is some stocks whose price fluctuate around 1000 rupees or more in same day, (stocks of Eicher Motors/ MRF).

So the bottom line you have to identify the lowest price or lower price area and have to buy it and have to sell it when the price will go higher in the delivery trading.

In delivery

This is the trading which most traders do and make money everyday or in a week /10 days /15 days/ 7 days.

What you need to learn in stock market to book profit

- When to enter the market to buy stocks

- When to exit from the market by selling it.

- How to save your capital invested in

stock market - how to book profit and

minimise your loss. - How to get out of wrong trade.

How to get out of wrong trade after buying a bad stock

- In share trading you can earn money, as well and you can lose money too and this happens to every

traders , but you should keep your loss to a minimum and this is the basic of stock trading. - Calculate what loss you can bear, and leave the stock with

bearable loss , and don’t wait for bad stocks to come up again.

You don’t need to bother too much about your stock

It is the